Pag-IBIG LOYALTY CARD Plus Discounts and Rewards

PAG-IBIG Fund has been with us for so many years, and yet most of us are curious about the perks of being a PAG-IBIG Fund member. Let me tell you one benefit that I'm always excited using, the PAG-IBIG Loyalty Card Plus!

PAG-IBIG Loyalty Card Plus Features:

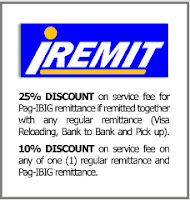

* Exclusive discounts and rewards from growing number of partner establishments (e.g. grocery purchases, tuition fee, hospital bills, fuel expenses, restaurant bills and a lot more from more than 300 partner-establishments nationwide).

* Can be used as a cash card to receive the proceeds of your Pag-IBIG Multi-Purpose Loan (MPL).

* Can be used as a cash card to receive the proceeds of your Pag-IBIG MP2 Savings Dividends.

* Can be used to withdraw cash in an ATM.

* Can be used as a debit card when you shop.

* Has an EMV chip that ensures that your transactions are always secure.

*

Who can Apply?

* Active Pag-IBIG Fund Members.

How to Apply (Branch Enrollment)

1. Accomplish a Pag-IBIG Loyalty Card Plus Application Form (HQP-PFF-108).

2. Submit the application form at the Pag-IBIG Fund Branch nearest you, along with a photocopy of one valid identification (ID) card. Kind present your ID card for verification.

3. Pay the corresponding card fee to accredited bank-operator.

4. Have your photo and biometrics taken.

5. Confirm your details as encoded by the accredited operator.

6. Congratulations! You shall immediately receive your Pag-IBIG Loyalty Card Plus.

Reminder:

* For you security, kindly change your PIN number upon receiving your card.

* always bring your Pag-IBIG Loyalty Card Plus brochure with you.

Application Fee:

* ₱125.00

Partner Banks:

1. Asia United Bank (AUB)

2. Union Bank

PARTNERS AND BENFITS

GLOBAL PARTNERS

NATIONAL PARTNERS

BEAUTY AND WELLNES

CLOTHING

DEPARTMENT STORES AND SUPERMARKET

EDUCATION

FOOD AND RESTAURANTS

|

HARDWARE, APPLIANCES ABD AUTO SERVICES

HEALTH AND MEDICATION

HOTELS

LEISURE AND RECREATION

MEMORIAL PLAN

TRANSPORTATION

.jpg)

Comments

Post a Comment